Delight customers and offset card processing costs with Clover Cash Discount

Editorial Team

5 min read

Today’s small businesses often deal with unpredictable cash flow and thin margins. Cash discount is a compelling solution that’s proven to offset processing costs, drive repeat business, and keep customers satisfied.

Today, Clover is excited to make it easy for merchants to offset their processing costs by offering cash discounts at checkout through the Clover Cash Discount tool. And, it offers merchants more flexibility to price their products just the way they need to help their business thrive.

What is a cash discount?

A cash discount serves as an incentive to customers who pay with cash. What’s more, merchants who offer cash discounts can adjust their shelf price to offset card processing costs and protect their profit margin.

Restaurants and other specialty industries have been using this process for years. During the past decade, the practice has become more common and used by business owners in many industries.

Meet Clover Cash Discount

Clover’s new Cash Discount tool is available on all Clover devices that accept cash. With no registration required and simple setup, Clover is making it easy to offset processing costs and provide customer incentives right from your existing POS system.

How does Clover Cash Discount work?

Imagine you run a cafe that earns $200,000 in revenue annually. The café pays approximately 3% in credit card processing fees, amounting to $6,000 each year.

Clover Cash Discount allows merchants to set discount rates ranging from 1% to 5%. The default value is 4%, and your café decides to stick with this default. You then carefully review your menu pricing to ensure that each item covers standard card processing fees. When you’re paid, you receive the exact amount you expect–card or cash.

Of your customers, 10% of sales opt to pay with cash to take advantage of the immediate discount being offered. The café offsets the processing fee for the sales that are paid by card, saving $6,000 annually.

What’s more, your customers are thrilled to see they can save on their morning coffee simply by paying in cash. The positive response potentially leads to a 5% increase in repeat business, contributing an additional $10,000 in annual revenue.

Ultimately, the Clover Cash Discount tool brings a $16,000 financial benefit to your café. Plus, with the uptick in repeat customers the café sees–thanks to the cash discount–you’re building an organic loyalty program that incentivizes your regulars and word-of-mouth referrals, among other intangible benefits that fuel growth.

3 benefits of Clover Cash Discount

As the example above demonstrates, the benefits of implementing Clover Cash Discount go beyond offsetting card processing fees.

1. Cash Discount preserves the bottom-line

Cash discounting can significantly boost a business’s bottom line by offsetting payment processing fees, which can range between 2% to 4% per transaction for card payments. Over time, these savings accumulate, creating a substantial positive impact on the bottom line.

2. Cash Discount drives higher revenue

In general, consumers are highly responsive to discounts and incentives. That means the perceived value of saving money can encourage customers to increase the amount they spend per visit. And, an uptick in spending can mean more revenue for the business.

3. Cash Discount improves customer satisfaction

Last but not least, implementing Clover Cash Discount can enhance the overall POS experience and improve customer satisfaction. Customers appreciate the opportunity to save money instantly when paying with cash, leading to a positive perception of the business

What’s the difference between a cash discount vs surcharge?

Cash Discount and Surcharge both aim to help businesses manage card processing fees, but differ in terms of legal aspects, customer preferences, and business goals.

Cash Discount is applied at the checkout. A product’s listed price includes the cost of card processing, and the discount is applied when a customer makes a cash payment. Essentially, the customer pays less than the list price if they choose to pay with cash.

Cash Discount is legal in all states without specific regulatory requirements. Because cash discounts are presented as a reduction in price, customers may find them more appealing as a perceived saving.

Comparatively, a Surcharge is a fee added to the total purchase amount when a customer pays with a credit card. Surcharging is prohibited or restricted in several states, including Connecticut, Massachusetts, and Puerto Rico. A Surcharge must be clearly disclosed to customers, and it should not exceed the cost of acceptance or 3% of the transaction total.

This table highlights some of the key differences between cash discounts and surcharges.

| Cash Discount | Surcharge |

| Allowed in all states | Prohibited in some states |

| Merchants’ shelf prices are card prices | Fiserv capped at 3% based on some card brand rules |

| No card brand registration is required | Registration is required with card brands |

| Merchants should post disclosure/signage that a cash discount will be applied if payment is cash | Merchants must post disclosure/signage that a surcharge will be added to credit card transactions |

| Can be applied to cash transactions only | Can be applied to credit card transactions only |

How do I display the pricing?

Dual Pricing is the practice of setting different prices for the same product or service. Merchants typically use Dual Pricing to identify different prices for cash vs non-cash payment tender.

- Dual pricing is a form of disclosure to consumers–it would be considered another form of Cash Discounting.

- Merchants would either Surcharge (charge the consumer the higher price for credit card transactions at the POS) or offer a Cash Discount (provide the lower/discounted price if the consumer is paying with cash tender).

- Merchants who offer either Cash Discount or Surcharge may present dual pricing by displaying distinct prices for the same product based on the payment form factor.

Cash Discount is available on all Clover devices that accept cash–no card brand registration required. All you need to do is reflect your ‘shelf’ prices as card prices and provide disclosure to your customers that you’re offering a cash discount.

To start using Clover Cash Discounts, simply contact a Clover Business Consultant.

Related Posts

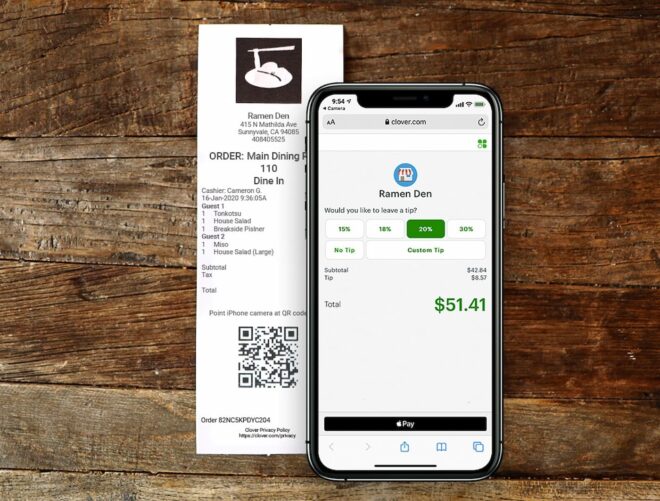

‘Dine and dash’ redefined with new Clover Scan to Pay feature

The importance of Giving Tuesday for small business

Popular Topics

Stay in touch

Sign up and learn more about Clover.

Thank you for your subscription!

More posts about starting a small business

eBook