Common hourly payroll mistakes and how to avoid them

Editorial Team

6 min read

When your business scales to the point you can no longer manage all the work on your own, it’s time to hire employees. Of course, hiring employees means you need to pay them—and that entails setting up a solid payroll strategy.

Many factors go into making sure your employees are paid the right amount, at the right time, with the necessary legal requirements met. With multiple steps in the payroll process, it’s easy to make mistakes—especially when you’re doing it all yourself.

According to the IRS, 40% of businesses file payroll incorrectly and face fees or penalties that can grow to a surprising size. In fact, the IRS collected $7 billion in payroll fines from 5 million businesses in 2017, according to the American Payroll Association.

Familiarizing yourself with the most common payroll mistakes and learning how to avoid them is the best way to avoid running into a potentially costly issue. If you need help optimizing your payroll, Homebase Payroll automates the process for you, so you can pay your team in a matter of clicks.

Payroll tax errors

Making a mistake when filing your payroll taxes—or not paying them at all—is dangerous and can result in serious fines from the IRS. The most common payroll tax mistakes are missed or late payments.

If you’re between 1 and 5 days late on your payment, the IRS charges you a penalty equaling 2% of the required sum. Payments that are 6 to 15 days late result in a 5% penalty, and if your payment is more than 16 days late, you’ll be subject to up to 15% of the required sum in penalties.

To ensure you don’t miss any required tax deadlines, you’ll need to learn about the payroll taxes you’re required to pay. These include:

- FICA: The Federal Insurance Contributions Act (FICA) requires you to withhold 6.2% of the employee’s taxable wages for Social Security and 1.45% for Medicare tax.

- Federal income tax: Your employee’s Form W-4 will help you determine how much you need to withhold in federal income tax.

- FUTA: This money goes toward federal unemployment insurance and will cost you 6% of the first $7,000 each employee earns.

There are two deposit schedules, monthly and semi-weekly. You’ll need to determine before each calendar year begins which deposit schedule you are required to follow. This is based on your reported tax liability on Form 941. Learn more about determining your schedule here.

The good news is that Homebase Payroll puts your payroll tax filings on autopilot, so you don’t have to worry about missed deadlines. Homebase handles tax calculations, sends direct deposits, and files your taxes for you.4

Employee classification mistakes

As you bring on new workers, how you classify each role impacts how you’re required to pay employees. It’s important to determine if your worker is an ‘employee’ or an ‘independent contractor.’ Unfortunately, it’s very easy to get them mixed up, and the distinctions of each can seem unclear. According to the Economic Policy Institute, an estimated 10-15% of employers misclassify at least one worker as an independent contractor.

Misclassifying an employee as an independent contractor can result in a fine of 1.5% of all wages paid to the employee, $50 for not filing Form W-2, 40% of employee FICA taxes, and 100% of employer FICA taxes.

If your misclassification is determined to be intentional, you could face having to pay up to 20% of employee wages, 100% of employee and employer FICA taxes, and criminal penalties of up to $1,000. You could even face up to 1 year in prison.

According to the IRS, “the general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done.”

The independent contractor common law test is used by the IRS for tax purposes. If any of the following controls are involved, then the worker is considered an employee:

- Behavioral control: Do you control what the worker does and how the worker does the job?

- Financial control: Do you rightfully control your worker’s finances in any way?

- Relationship of parties: Are you providing benefits that are usually offered to employees? Is the job long term? Is the work a key aspect of business operations?

Incorrect recordkeeping

If for some reason you are subjected to an IRS audit, it’s critical that your payroll records are accurate, complete, and organized. Any errors can lead to various fines and penalties.

For example, if the IRS finds during their audit that your W-2’s aren’t complete and filed for every employee, they’ll charge you between $50 and $260 for each W-2, depending on how late you are on the filing. If you hired a group of freelancers to help with your marketing and did not send them their 1099s, the fine is $250 per independent contractor.

The IRS requires you to maintain employee and payroll records for at least 4 years, and the Small Business Administration suggests you keep payroll records for at least 6 years.

Homebase Payroll can help make the recordkeeping requirements a breeze. It automatically submits your new-hire reporting and files and distributes W-2s and 1099s, and even stores your hourly employee time card records to keep you compliant with the FLSA recordkeeping rules.

Overtime errors

Non-exempt hourly employees are entitled to overtime pay of 1.5 times their wage rate for all hours worked in excess of 40 per week. You’re likely already scheduling employees no more than 40 hours a week to avoid overtime costs, but it’s critical that you keep track of overtime hours for each team member and pay them accordingly–whether they were originally scheduled to work those hours or not.

If you miscalculate or fail to pay overtime to an employee, they may file a complaint with the Department of Labor, which could result in a fine equalling 100% of owed overtime pay, plus actually paying the wages. You could also face civil penalties of up to $1,000 per violation.

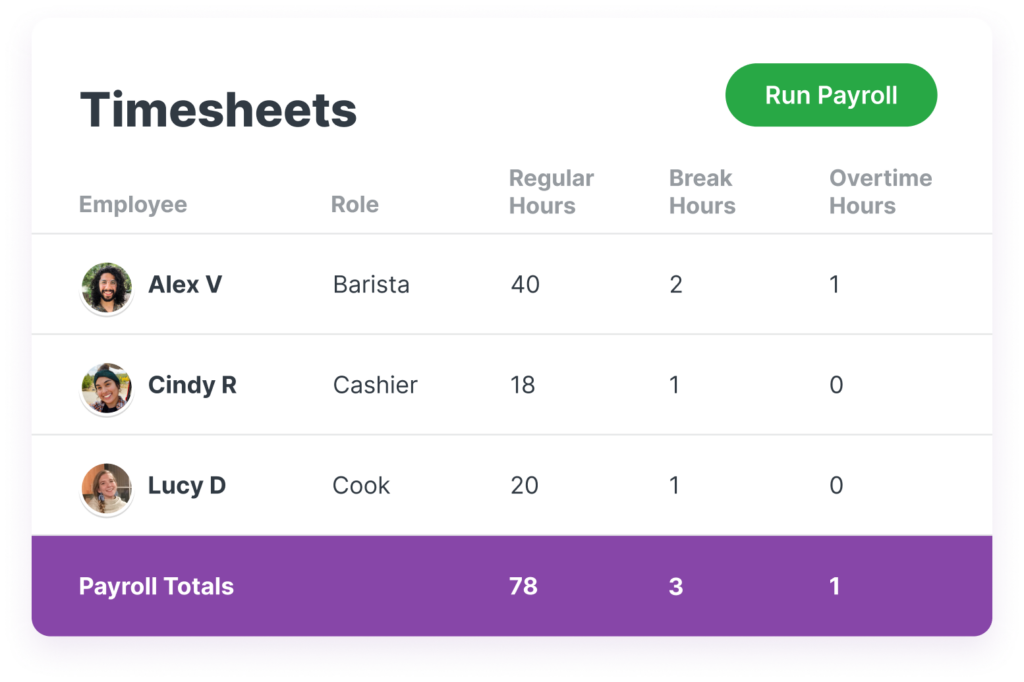

Be sure to keep meticulous records of overtime. This may seem tedious, but Homebase is here to help. When your team clocks in and out in Homebase, their hours are instantly calculated, as well as their breaks, overtime, and PTO. All that data is then synced to your payroll to help you avoid mistakes.

Too many platforms

Utilizing a full-service payroll provider is a great way to avoid the most common mistakes other businesses make. However, if you’re using separate providers for employee time tracking and payroll, you may end up having to put in just as much time and effort as you would if you were running payroll without the help of a platform.

A well-rounded solution like Homebase can save time and reduce errors by consolidating data in one place. Not only does Homebase handle your scheduling, time tracking, and team communication, but it also takes care of tax calculations and filings, direct deposits, and required recordkeeping.

You can simplify your payroll strategy and avoid unnecessary mistakes by signing up for Homebase today!

This information is provided for informational purposes only and should not be construed as legal, financial, or tax advice. Readers should contact their attorneys, financial advisors, or tax professionals to obtain advice with respect to any particular matter.

Related Posts

How to start a small business in 9 simple steps

Salon ownership: Your guide on how to open a salon

Popular Topics

Stay in touch

Sign up and learn more about Clover.

Thank you for your subscription!

More posts about starting a small business

eBook