Merchant talkback: What’s your biggest business challenge and how are you handling it?

Editorial Team

8 min read

How can merchants take on the challenges of owning a small business—staffing problems, cash flow issues, getting their name in front of customers—and still get ahead? We asked them what their biggest challenges were and how they were tackling them. Here’s what they said.

Problem: Getting (and keeping) the right employees

“Staffing is a challenge,” says Andy Mullins, head of Nobletree Coffee. A company growing quickly needs to stay proactive.”

And the battle isn’t over once you’ve landed the right candidate—in fact, you could say it’s just begun. Employee retention is a problem for many small businesses, but there are also opportunities to turn perceived weaknesses into strengths.

Solution: Nate Masterson, an HR manager for natural beauty product firm Maple Holistics, said that larger companies have “so many people doing your job,” which creates more competition when roles become available. Smaller firms present a different playing field, Masterson said, because “if you’re good at what you do and show talent and skill, you’ll be given new responsibilities [and] taught new skills and groomed, making you that much more valuable to the market.”

Emphasizing the opportunities for growth, being part of the community, and the passion for what they do helps small businesses stand out as wonderful places to work.

Problem: Managing your cash flow

Most owners start their businesses because they have a passion for what they do. Hair stylists love beauty, barkeeps open pubs to build community, and chefs open restaurants because they love to cook. But rarely does anyone open a business because they love business.

When business or finance isn’t a business owner’s first language, they can struggle to succeed. “I really wish I would have understood business better when I started rather than just having industry-specific knowledge,” says Dennis Gullo, a spa owner in New Jersey. “I was an education junkie but only in the salon business.”

Philip Campbell, a CPA and former chief financial officer in several companies, says “poor cash-flow management is causing more business failures today than ever before.”

Solution: It can be tough to track money coming in and going out of a business. This is why business owners should turn to new technology like Clover Rapid Deposit, which allows merchants to get their funds receivable next-day and frees them up to do what they do best.

But not all cash flow problems are related to a lack of know-how. In fact, some issues are caused by experiencing too much success. “Growing your business puts a huge strain on cash,” Campbell said, also stating that you often have to make investments long before you’re able to see a return on that money. Whether it’s investing in inventory or opening a new location, business growth requires money up front.

Again, working with new technology may be the key to overcoming this problem. Clover Capital allows small business owners to get working capital through a loan to help expand their businesses, then repay that loan through future credit card sales.

Problem: Finding (and using) the right technology

Keeping up with new technology—or the feeling of having to keep up with new technology—can be a difficult struggle for small business owners.

Justin & Brie Henshaw, owners of Fuse Frozen Yogurt, discovered first-hand that robust is not always best when it comes to business technology. “We used to have a very in-depth, very complicated, very expensive [point-of-sale] system that we used to use, and I wanted to find a better way,” said Justin.

Solution: The Henshaw’s discovered that enterprise-scale technology that has all the bells and whistles is probably not the best choice to serve a small business’ needs. Instead, they opted for a Clover POS system, which allowed them to focus on the features that truly made a difference in their business, which in turn allowed them to focus on other areas of the business. That simplification was what allowed their business to grow.

Problem: Getting the word out

Some small businesses struggle with how to stand out in the crowd. They don’t always have the budget for national, or even regional ad campaigns like their bigger contemporaries, so they must turn to different marketing and branding sources.

Solution: Tower Paddle Boards and Beardbrand are two small businesses that both turned to digital content marketing as they worked to gain market share. “Figure out what people are searching on and provide that content,” said Stephan Aarstol of Tower. “It’s as simple as what questions are people asking and answer those questions and answer them well.”

“If you want to create a brand, you have to provide value to the life of the consumer beyond just the products,” added Eric Bandholz of Beardbrand. “So much of that is the content, whether it be education or entertainment.”

Other ways small businesses can market their brands is by offering unique customer experiences that set them apart from big-box stores. “People’s palates have become more sophisticated, with the Food Network and foodie culture,” says Daniel Sterling, the CEO of Seattle donut startup FROST. “We try to make coming to FROST a fun experience for everyone that comes in.”

FROST rotated flavors several times per week shortly after they opened to see which donuts sold the most. As time went on, that variety and novelty became a part of their brand. Sterling said that the unique flavors are “the number one reason people come to FROST. People are used to getting interesting products from us, not your typical things.”

Problem: Minimum wage hikes

One of the biggest challenges small business owners face is the rising minimum wage which is seen in progressive cities and states throughout the country. While these rising wages are theoretically good for workers, they present several problems for small business owners, not the least of which the fact that many report cutting hours or staff due to the higher wages.

“It’s not like I’m taking home so much that I can take it out of my pocket,” Alli O’Neill, owner of a bakery in New Jersey says. “I wish I could. I think there are big businesses out there that can do that. But the small businesses can’t.”

Solution: Some companies, like Protein for Pets, look to replace workers with automated and outsourced technology as they grow, eliminating the problem wage hikes present. “We are actively planning for an increase over the next three years,” says Marco Giannini, the CEO of Protein for Pets. “Companies should look to outsourcing more technology and services.” Small businesses can now look to apps that integrate with the Clover POS that can handle scheduling and accounting concerns, which frees the owners to hire more customer-facing employees, which in turn will help the business grow.

Other small businesses are looking outside the box for incentives that could take the place of rising wages. “If the rise in minimum wage had a ripple effect that ended up pushing our hourly employees to ask for more money,” said Andrew Schiller, the CEO of Location. He suggests promoting peripheral benefits employees can access: “flexibility in scheduling, frequent free lunches, casual environment and more.”

Problem: Customers abusing return policies

A constant problem for any business is returns, however enterprise-level businesses can eat the cost of a return a lot easier than a small business. That’s why small business owners must decide on the right return policy for them and their customers.

For Vladimir Gendelman, the founder and CEO of Printwand, a custom printing and promotional-item business, it’s important to keep the return and refund policies simple. “Customers do not want to jump through hoops if something doesn’t work out for them,” says Gendelman.

Solution: The customer experience drives return policies for other small businesses as well, albeit in different ways. While your official policy may be 30 days or to charge a restocking fee, that might not be the best way to go according to Brad Schweig of Sunnyland Patio Furniture. “In practice, we’ll take things back pretty much whenever as long as it is sellable and current. It is not worth the bad vibe with the customer to play games with the return policy, and it provides peace of mind with them if they don’t like their selection.”

Others, though, take a completely different tack when it comes to returns. Magnolia Emporium, a curated home decor, gift, art, and gourmet shop does not have a return policy. “We actually solved that [problem of designing a good return policy] by not offering any returns. [We] have tried many options over the last several decades and this is the only thing that works correctly.”

Whatever your return or refund policy is, it’s important to make sure your customers are aware of it to avoid any confusion. For some, this means hanging up signs around their cash registers with their policies clearly written out. Magnolia Emporium, on the other hand, has their Clover POS system print their return policy right on the customer’s receipt.

Whatever challenges your small business faces right now, there are solutions out there to help overcome them and turn your business into a success.

Related Posts

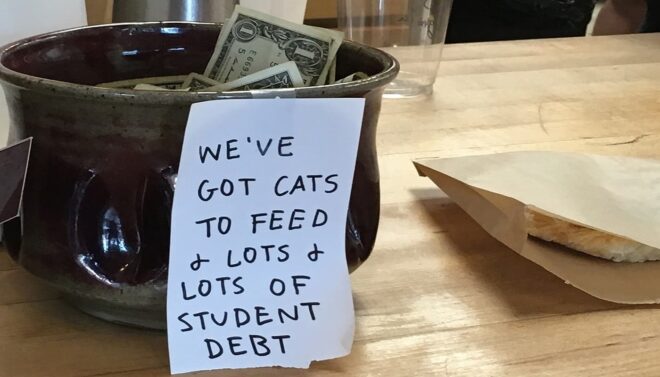

4 simple and creative ways to ask for tips at your business

Blind date with a book: How to increase engagement with your bookstore

Popular Topics

Stay In Touch

Sign up and learn more about Clover.

Thank you for your subscription!

Recent Stories

- How to design a restaurant recipe card–and share it

- Is your business a victim of shrinkflation? Don’t pay more for shorter receipt rolls.

- How to buy a restaurant

Please share your contact information

to access our premium content.

Thank you for sharing your contact information.

Download Now